Donate

BE PART OF SOMETHING BIG

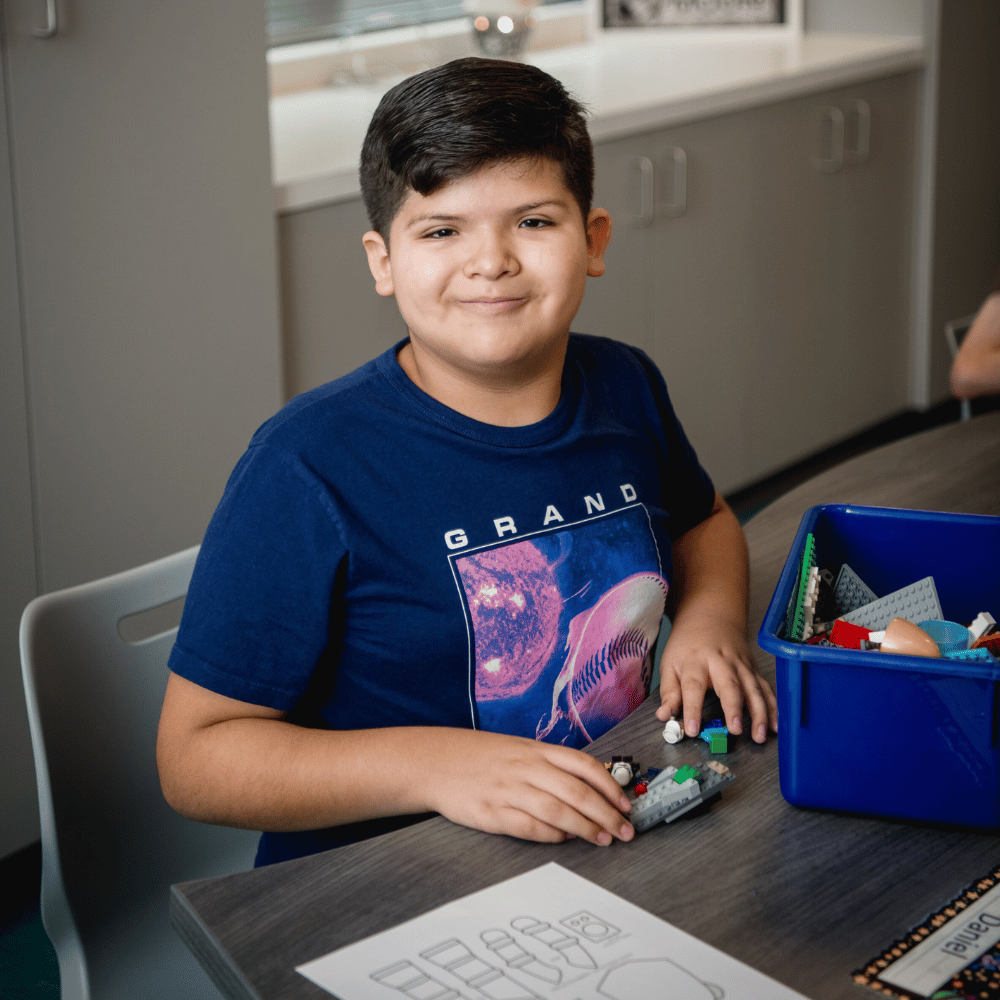

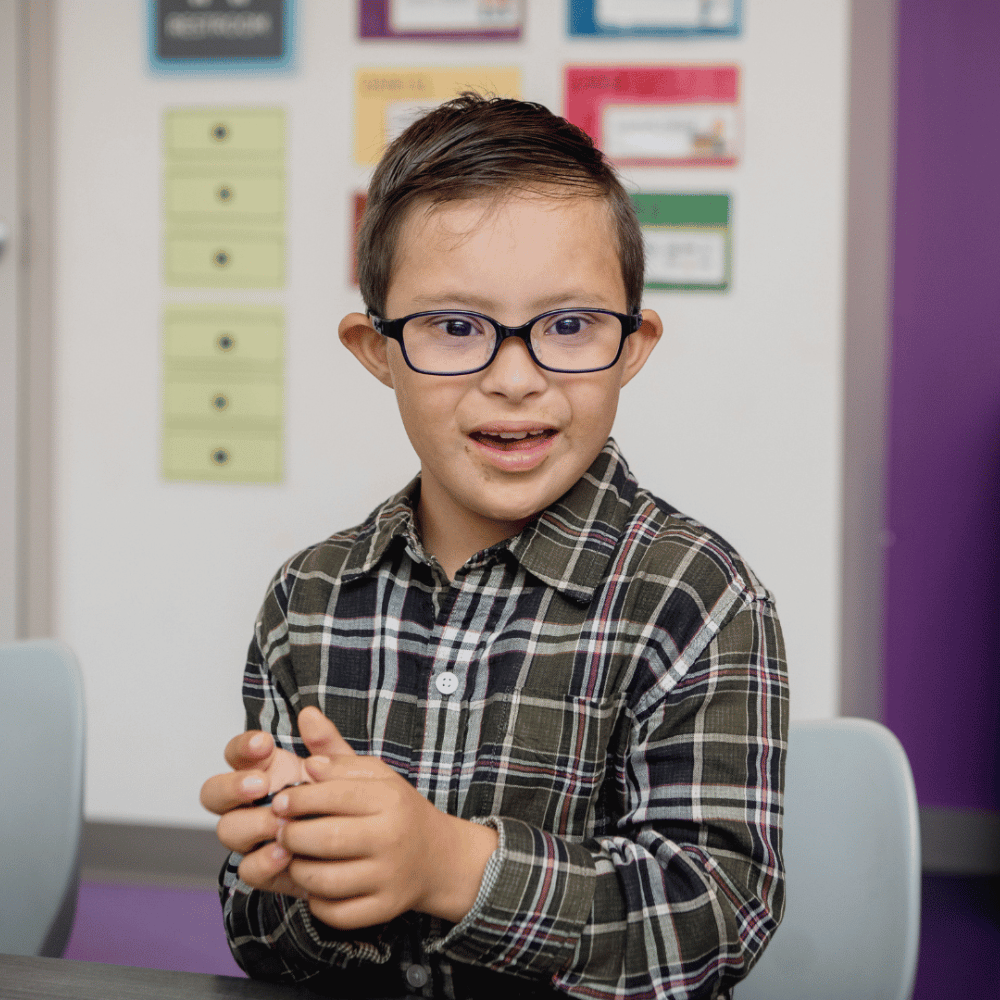

Real results require a real investment, and we are committed to offering the most comprehensive special needs education program in Houston.

A donation to The Arbor School celebrates learning beyond limitations! As a nonprofit organization, we depend on the generosity of our community to help meet the operational needs of the school. While we do charge tuition, every family receives a silent scholarship as no one pays the true cost of tuition. Tuition accounts for roughly 65% of the total operational costs necessary to keep our doors open and we work to raise the rest. The Arbor receives no government or United Way funding and relies on the generosity of its committed network of friends and families.

Every dollar you contribute, no matter the size, helps The Arbor to fulfill its mission. Most gifts are tax-deductible, and all gifts directly impact our students. Thank you for making a difference!

GIVE TODAY

The Arbor depends on the generosity of our community to help sustain and further our mission. Your donation helps us to remain the most comprehensive special needs education program in Houston for children with a wide range of developmental delays, 6 weeks through age 18.

GROWING FUTURES

GIVING SOCIETY

Become a member of the Growing Futures Giving Society with a multi-year pledge and help celebrate bright futures at The Arbor!

SPECIAL EVENTS

We have several special events throughout the school year and ways to get involved in the life of The Arbor.

FUN WALK

CHEVRON HOUSTON MARATHON

LEGACY OF HOPE LUNCHEON

LEGACY GIVING

Planned gifts are a thoughtful way to provide for the future needs of The Arbor and allow you to direct your legacy toward what is meaningful to you. Gifts may be unrestricted (to be used for the highest and best use at the school when received) or restricted to a specific area where you wish to make an impact.

OTHER WAYS TO GIVE

THANK YOU FOR SUPPORTING THE ARBOR SCHOOL!

We look forward to working with you as we see more achievement for our students and their families in the years ahead. To receive more information on ways you can help The Arbor School, please contact our Development Office at (713) 322-7394, or send an email. Our Taxpayer Identification Number is 76-0317198.

The Arbor School is a 501(c)(3) tax-exempt organization and subscribes to the Donor’s Bill of Rights. All donations made to The Arbor School are tax deductible to the full extent of the law.